2024 1040 Schedule A Line – The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for . The money you win from placing bets on your favorite sports team is considered income, no matter how little. The IRS considers all winnings from gambling fully taxable, whether from a website, app, .

2024 1040 Schedule A Line

Source : thecollegeinvestor.comWhere To Find My 2022 Tax Information (2024–25) | Federal Student Aid

Source : studentaid.govBusiness tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.comWhere To Find My 2022 Tax Information (2024–25) | Federal Student Aid

Source : studentaid.govForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgIRS Refund Schedule 2024 Date to recieve tax year 2023 return!

Source : www.bscnursing2022.comIRS Refund Schedule 2024 Date to recieve tax year 2023 return!

Source : www.bscnursing2022.comTax Due Dates For 2024 (Including Estimated Taxes)

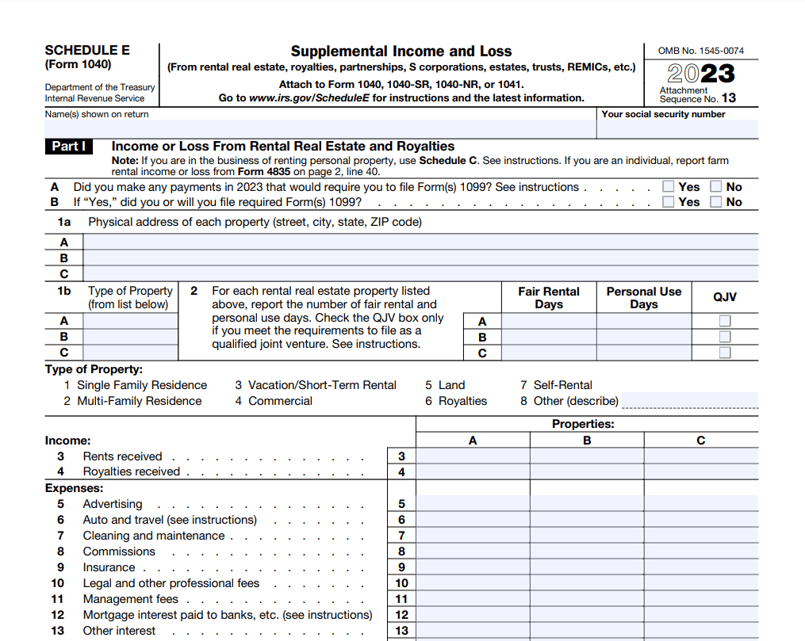

Source : thecollegeinvestor.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.comIRS to Launch Free E Filing Program in 2024. Here’s What to Know

Source : www.nbcboston.com2024 1040 Schedule A Line When To Expect My Tax Refund? IRS Tax Refund Calendar 2024: Form 1040, Schedule C, Line 1 Report all money you collected in your business on Line 1 of Schedule C. This amount should include all commercial sales taxes you collected. You do not need to . Because these deductions are itemized on Schedule A (line 20) of Form 1040, if you file taking the standard deduction, you’re out of luck. The other catch is that these write-offs typically fall .

]]>

.png)

.png)