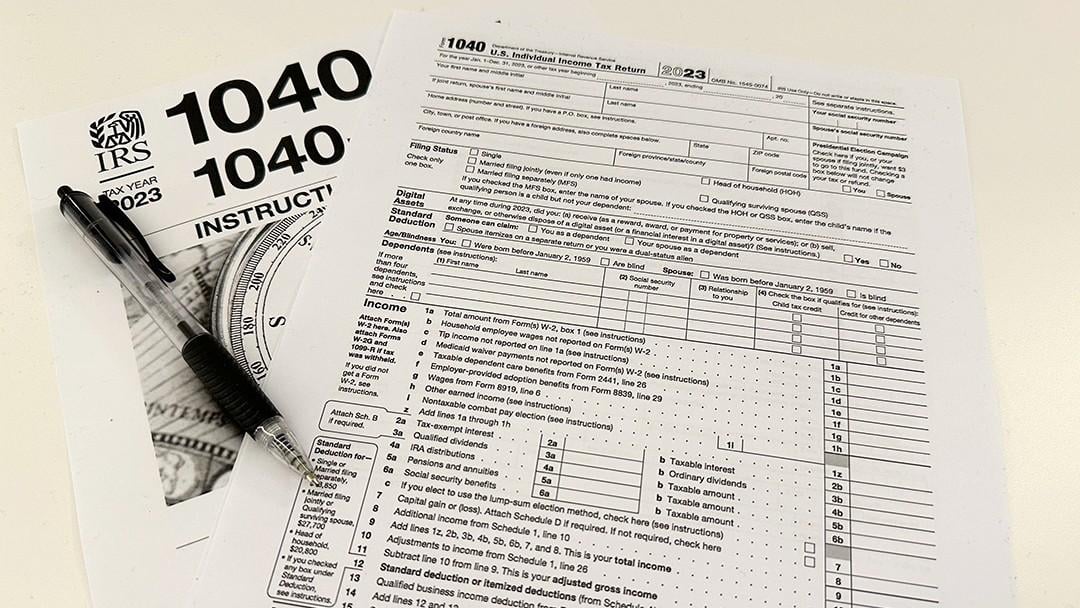

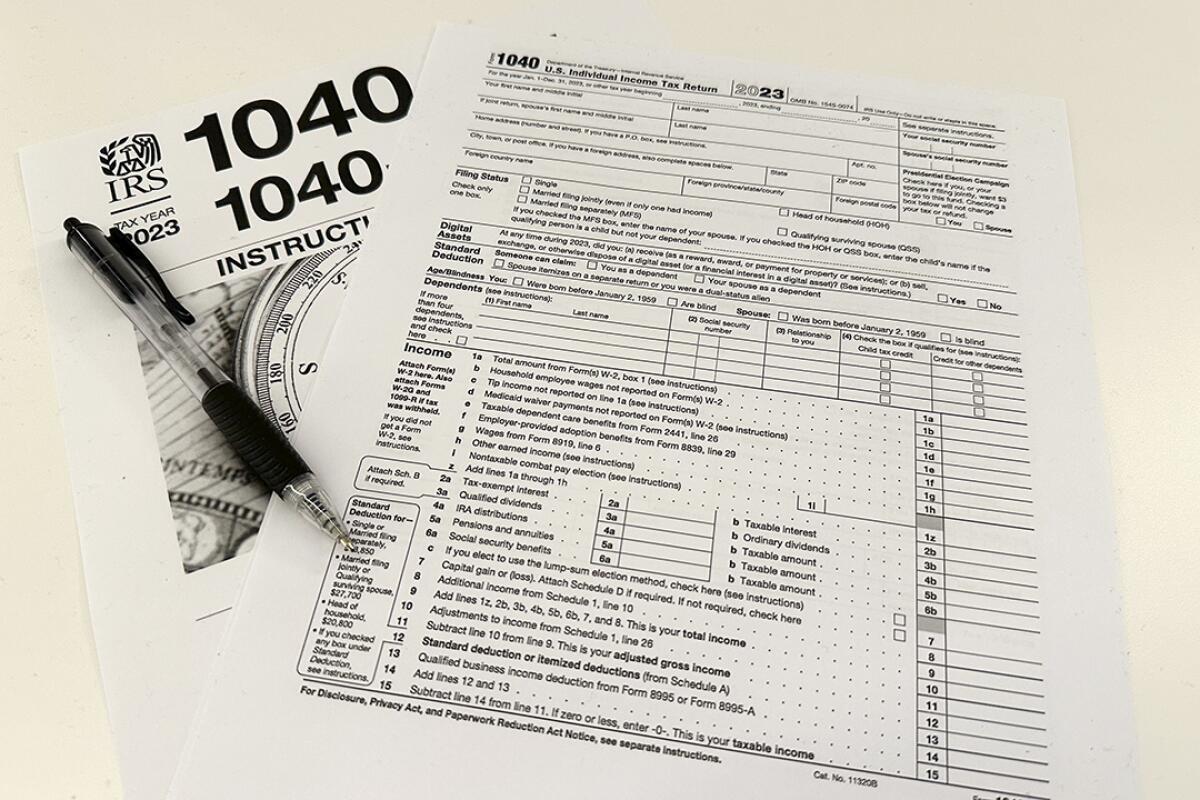

2024 1040 Schedule A Instruction – To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are . The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the are not listed on the standard Form 1040. It includes sections for reporting .

2024 1040 Schedule A Instruction

Source : www.incometaxgujarat.orgSchedule E Instructions: How to Fill Out Schedule E in 2024?

Source : www.noradarealestate.comArizona, federal tax season begins with changes, tips for filers

Source : yourvalley.netForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgIRS Unveils 2024 1040 Tax Forms, Schedules, and Instructions for 2024

Source : www.cbs42.comTax season is under way. Here are some tips to navigate it. | WNCT

Source : www.wnct.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comTax Season is Under Way. Here Are Some Tips to Navigate It

Source : news.wttw.comTax season is under way. Here are some tips to navigate it. The

Source : www.sandiegouniontribune.comAP | Tax season is under way so how do we navigate? | Laurinburg

Source : www.laurinburgexchange.com2024 1040 Schedule A Instruction Form 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions : Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 . Sole proprietors may only need the form 1040, Schedule SE for self employment Fill in each form according to the instructions, making sure no sections are skipped. In some cases you’ll need .

]]>

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)